Your Invoices May Include a Value Added Tax

Starting with November 1st 2020, we are bound by local & EU law to add 19% Value Added Tax to our invoices, in a few select cases....

Starting with November 1st 2020, we are bound by local & EU law to add 19% Value Added Tax to our invoices, in a few select cases....

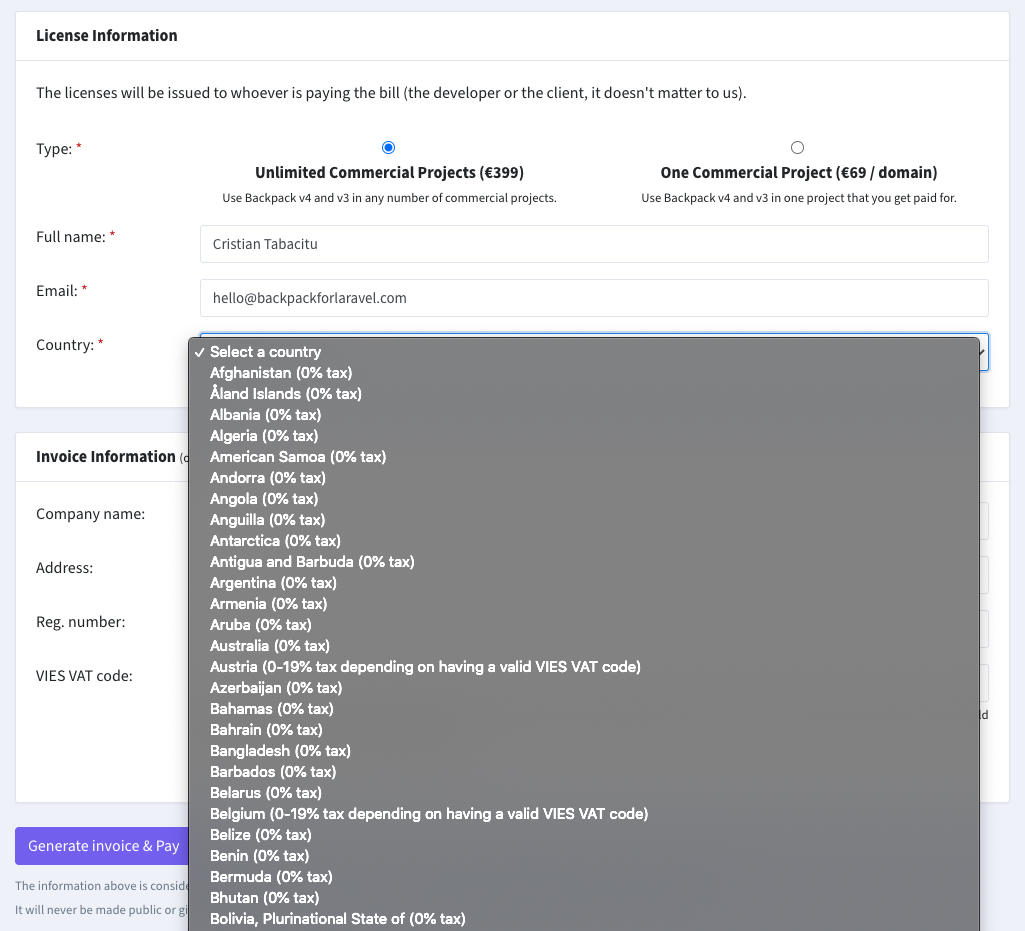

Starting with November 1st 2020, we are bound by local & EU law to add 19% Value Added Tax to our invoices, in a few select cases. The vast majority of our customers will be unaffected, because it only implies changes to citizens and companies in the European Union.

However, in the spirit of full disclosure, we feel the need to tell you that starting with Nov 1st:

To rephrase, the new 19% Value Added Tax will be added to your invoice if you are a citizen from the European Union and if you represent a company from Romania.

To provide full transparency on this, we've:

We know this will be an inconvenience to some of you - particularly to Romanian companies who need the invoice to deduct the expense, so they can't just "choose a different country". It will be an inconvenience to us too. Unfortunately, it is something we're bound by law to do.

If you have any ideas on how to make this experience better, or have any problems with taxation, please let us know at [email protected]. We're all ears.

Subscribe to our "Article Digest". We'll send you a list of the new articles, every week, month or quarter - your choice.

What do you think about this?

Wondering what our community has been up to?